CHICAGO — As Chicago grapples with a worsening financial outlook across its schools, public transit, and city budget, former mayoral contender Paul Vallas is sounding the alarm on a familiar political refrain: taxing the rich.

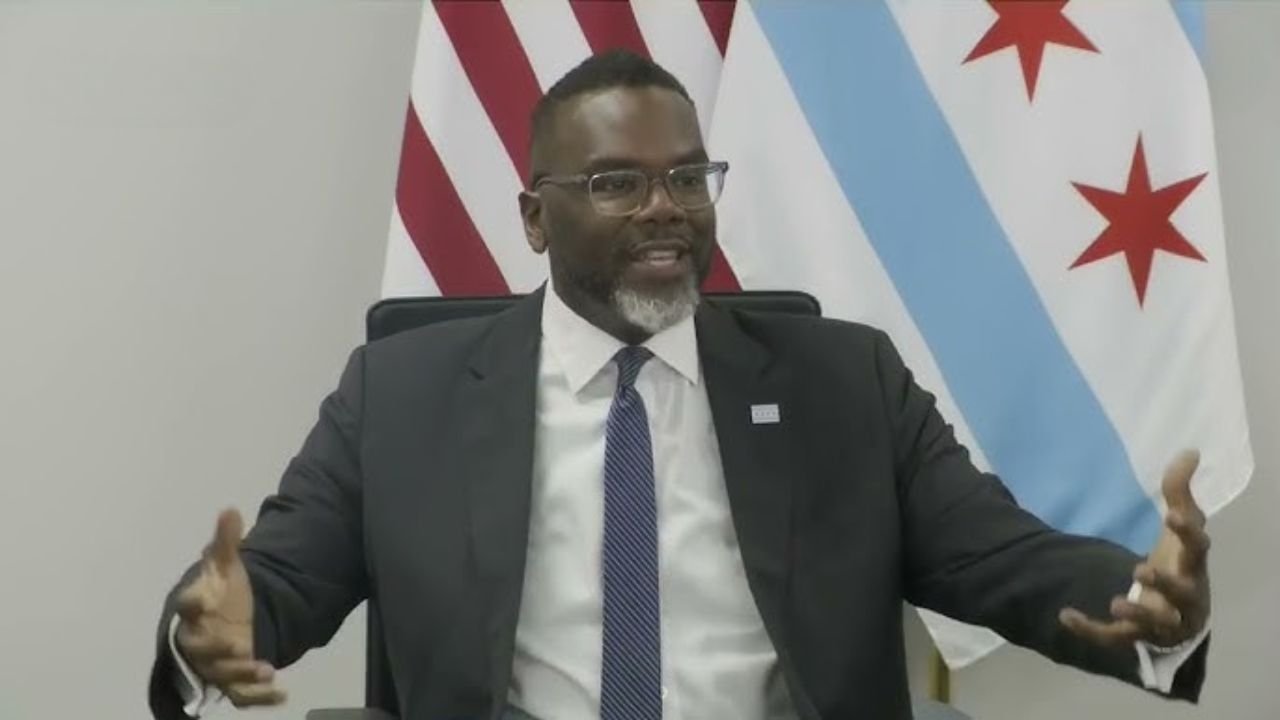

Mayor Brandon Johnson, who has championed higher taxes on wealthy residents to fill budget gaps, recently renewed his calls following the collapse of a transit funding bill. “Enough is enough. We need the ultra-wealthy to pay their fair share,” Johnson posted on social media, referring to the city’s efforts to maintain transit operations and prevent service cuts.

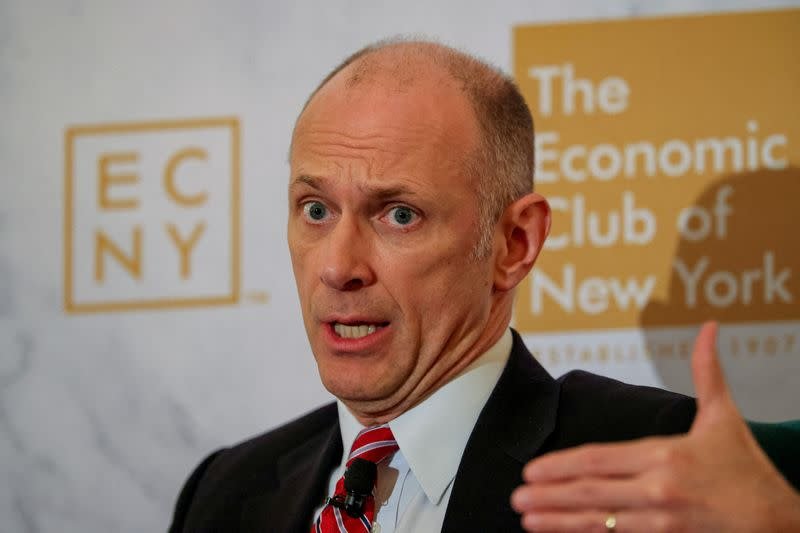

But Vallas, in a pointed editorial published by the Illinois Policy Institute, dismissed the approach as ideologically satisfying but fiscally reckless.

Spending Up, Enrollment Down: A Triple Crisis

Vallas argues the city is facing three simultaneous fiscal emergencies:

-

The City Budget

-

Chicago Public Schools (CPS)

-

Chicago Transit Authority (CTA)

According to Vallas, these crises have worsened due to unsustainable spending and a refusal to adapt to post-pandemic realities.

“Since 2019, city government spending has surged by $6.6 billion — a staggering 62% increase,” Vallas noted. Meanwhile, CPS spending per student is up nearly 40%, even as enrollment has dropped by 9%, and the CTA’s budget has ballooned by 40% while only recovering 68% of pre-pandemic ridership.

Despite receiving almost $6 billion in federal aid, Vallas points out that these entities still raised taxes and fees instead of scaling operations.

High Taxes Driving Migration Out of Illinois

Vallas contends that rather than a lack of taxation, excessive taxes are pushing people away from Illinois.

“Poll after poll shows taxes as the number one reason former Illinoisans left,” he wrote, citing data showing Illinois lost nearly 60,000 taxpayers earning over $200,000 since 2012.

Among young high-income earners aged 26 to 35, Illinois ranked as the second-biggest loser of residents nationally in 2022.

He also highlighted stark tax burdens:

-

Chicago’s sales tax is the second-highest in the U.S. (after Seattle)

-

Commercial property taxes are second only to Detroit

-

Illinois is projected to have the highest combined state and local tax burden in 2025, costing each household $13,099, or 52% above the national average

Case Study: The Ken Griffin Exit

One of Vallas’ most striking examples is billionaire Ken Griffin, the founder of Citadel and Illinois’ former richest resident. Griffin paid more than $1 billion in Illinois state income taxes over a decade and donated $130 million to 40 Chicago-based nonprofits.

“Since moving to Florida, Griffin has shifted his business and donated more than $300 million in that state,” Vallas noted, calling it a direct economic loss for Illinois.

Moreover, 10,000 employees reportedly left with Griffin — a major blow to the state’s economic base and future tax receipts.

What About Equity?

While proponents of wealth taxation argue it supports equity and justice, Vallas points to troubling state-level metrics:

-

Illinois ranks last nationally in equity on measures like poverty, homelessness, labor-force participation, homeownership, and unemployment.

-

Neighboring states like Indiana and Wisconsin have cut income taxes, offering up to $5,315 in annual savings for those who relocate.

A Warning Against “Feel-Good” Fiscal Solutions

Vallas concludes his critique by urging policymakers to abandon “short-sighted populism” and focus on structural reforms.

“Chasing high earners out of the state might sound like social justice to some, but in practice it backfires into social disintegration,” he warned.

Unless Illinois changes course, he argues, it will continue to lose people, investment, and long-term opportunity.

What’s Your Take on Illinois’ Tax Future?

Do you believe raising taxes on the wealthy is a necessary step toward equity — or a policy that risks further economic decline? Sound off in the comments on ChicagoSuburbanFamily.com.