CHICAGO — Financial tensions in City Hall are boiling over as Chicago’s borrowing costs increase, credit ratings stagnate, and aldermen express growing frustration with how the Johnson administration is managing the city’s escalating budget crisis.

Aldermen Reilly and Beale Sound the Alarm

At a heated June 3 Finance Committee hearing, Ald. Brendan Reilly (42nd) and Anthony Beale (9th) directly challenged the city’s top budget officials over the administration’s approach to closing the city’s $1.1 billion projected shortfall.

According to the Chicago Tribune, Reilly criticized the use of one-time revenues in last year’s narrowly approved budget and pointed to a lack of meaningful spending cuts:

“The mayor declared almost defiantly that this didn’t include any cuts or efficiencies. Because he doesn’t believe in cuts. That’s not part of his ethos,” Reilly said. “Those words stuck with me — they made me angry.”

$700 Million in Bonds Issued — at Higher Costs

Just a day after the hearing, the city issued nearly $700 million in bonds to fund infrastructure and refinance existing debt. But the new bonds came at a steep cost to taxpayers:

-

Average interest rate: 5.6%

-

Previous year’s rate: 4.2%

-

Estimated annual debt service increase: $10 million

Though rising national interest rates explain part of the difference, the Tribune editorial board noted that Chicago’s downgraded credit rating and investor skepticism are major factors inflating borrowing costs (Chicago Tribune).

Union Talks, Budget Study Raise Concerns

During the hearing, Budget Director Annette Guzmán and CFO Jill Jaworski faced sharp questions about labor negotiations and the upcoming $3 million Ernst & Young study commissioned to evaluate city finances.

Guzmán acknowledged the study would highlight how Chicago collects lower fines and fees than peer cities — a fact many saw as a prelude to recommending new resident charges rather than service cuts.

“When Johnson officials discuss cuts, they’re vague. When they discuss revenues, they’re very specific,” the Tribune noted.

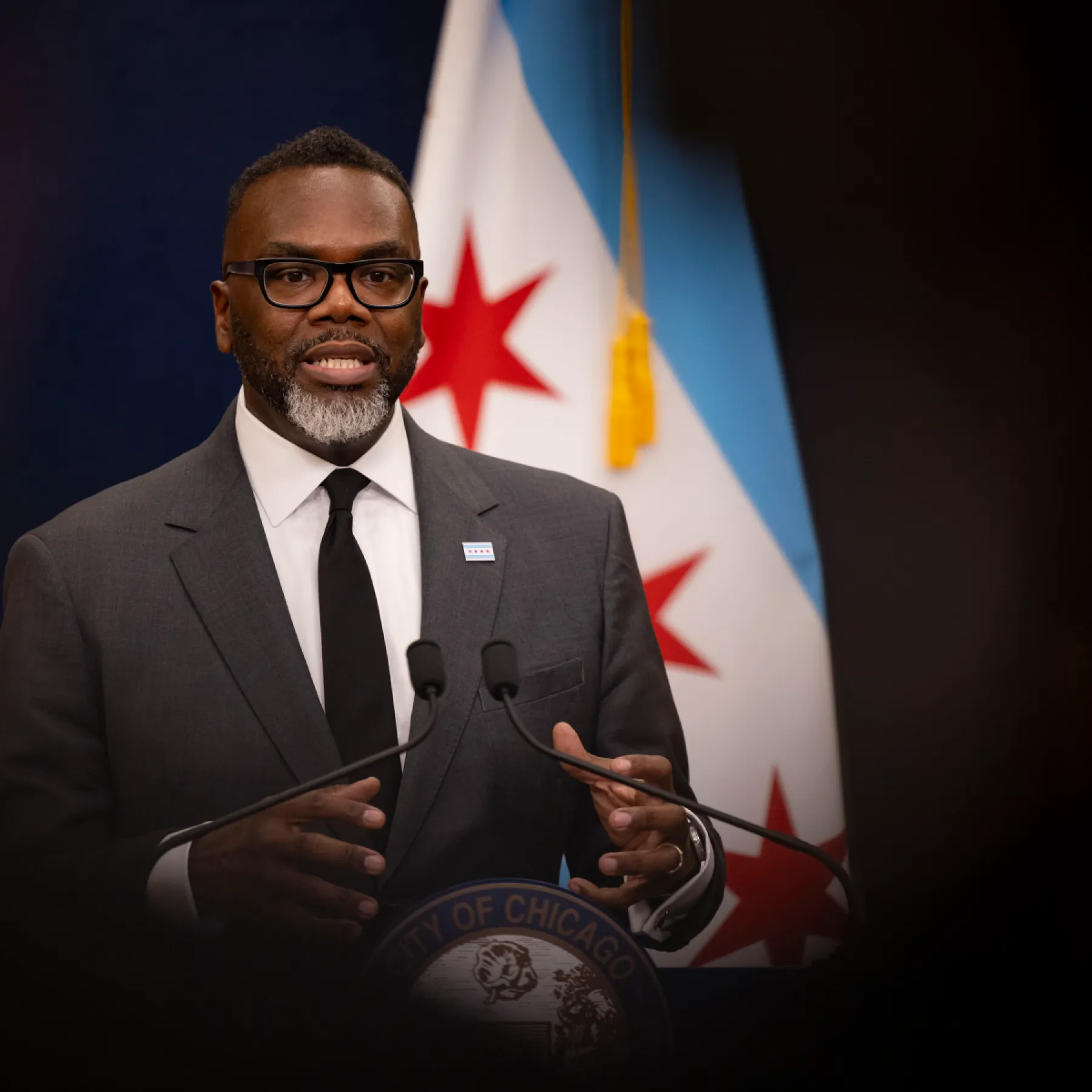

A Divided Council, A Pressured Mayor

Mayor Brandon Johnson, who previously proposed a $300 million property tax hike rejected by Council, now faces mounting pressure to present a viable plan. His calls for increased taxes on the ultra-wealthy have not gained traction among state lawmakers or city voters.

The Tribune editorial board argued that without concrete cuts, the city cannot stabilize its finances — and should not pursue new taxes like the proposed 1% grocery tax until reductions are made.

“Management in hard times means hard choices,” the editorial concluded. “Chicago must follow the lead of other cities like San Francisco and cut spending.”

How do you think Chicago should address its growing budget deficit?

Should the focus be on service cuts, new taxes, or structural reform? Join the conversation in the comments on ChicagoSuburbanFamily.com — your voice matters.