CHICAGO — As Chicago enters the heart of the 2025 summer housing season, a striking paradox is unfolding: home prices are climbing higher than ever — even as sales hit decade lows.

The median price of a home in the nine-county metro area hit $379,900 in May, and inside Chicago city limits, prices reached $390,000, marking the highest May pricing on record. Yet despite those booming values, sales volume fell to its lowest May level since 2012, not counting the pandemic-affected year of 2020.

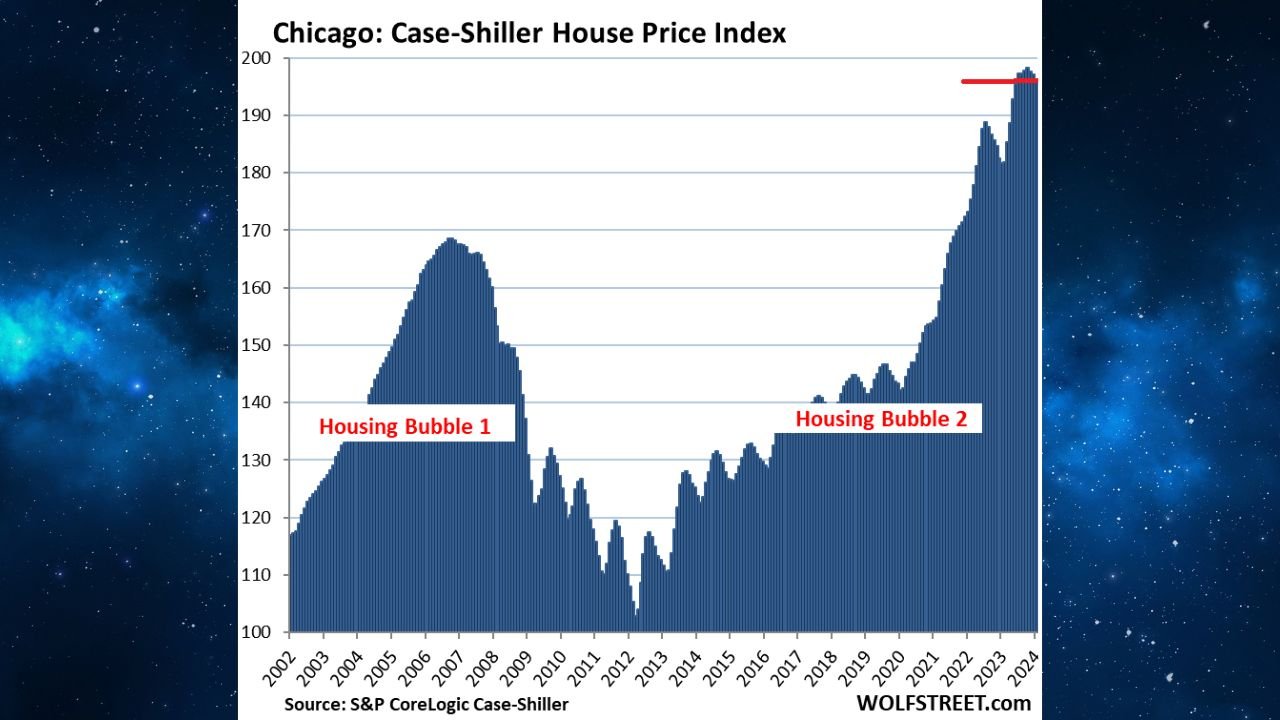

Housing Bubble 2? Chicago Prices at All-Time Highs

Chicago’s housing market has entered uncharted territory, according to the Case-Shiller Home Price Index. As visualized in the chart above, 2024 price levels have surpassed those of the 2006 peak, which marked the height of the last major housing bubble.

The current trend — driven by a severe inventory shortage, high demand, and speculative pricing — is sparking concern among economists, renters, and prospective buyers alike. Despite a noticeable slump in home sales, prices have continued to rise, creating a mismatch between affordability and market availability.

“This is clearly a pricing surge that’s happening without the sales momentum to back it,” said a senior housing analyst with the Illinois Association of Realtors. “That’s a classic bubble signal.”

The visual comparison between Housing Bubble 1 (2006) and Housing Bubble 2 (2022–2024) helps contextualize current market anxiety — especially for first-time buyers and working-class families trying to stay in the city.

Inventory Collapse and Seller Hesitation Driving Crisis

One of the clearest culprits: lack of housing inventory.

According to The Chicago Sun-Times, the number of homes for sale in May dropped 13.7% year-over-year, creating a bottleneck that’s pressuring prices upward while keeping many buyers sidelined. Homeowners with locked-in low mortgage rates — often under 5% — are choosing to stay put, rather than sell and enter today’s higher-rate market.

This reluctance is leaving buyers with fewer choices and higher price tags.

New Construction Lagging Behind Demand

It’s not just resale homes causing the crunch. The Illinois Economic Policy Institute reports that the state is short an estimated 142,000 housing units. At current construction rates, Illinois would need to double its housing output — adding 227,000 units over the next five years — to meet that demand.

That’s unlikely under current market conditions, especially as builders face rising material and labor costs.

What You Get for $390,000 in Today’s Market

Buyers working with the city’s new median budget of $390,000 can expect very different options depending on neighborhood:

-

In Austin, that price might fetch a historic five-bedroom home.

-

In River North, it may only secure a modern two-bedroom condo.

But competition is stiff across the board. Rehabbed homes and luxury downtown condos are drawing intense interest, yet they’re harder than ever to snag — especially for first-time buyers or those without all-cash offers.

Chicago Housing Prices Outpacing National Growth

While other metro markets are cooling, Chicago’s 5.5% home price increase in May outpaced the national average by more than four times, according to The Real Deal. This positions Chicago as one of the few major cities where demand is still hot — but access is increasingly restricted to the well-resourced.

Why It Matters for Locals and Policymakers

This pricing surge and supply stagnation are impacting multiple groups:

| Affected Group | Consequence |

|---|---|

| First-Time Buyers | Facing fewer affordable homes and greater competition |

| Renters | Trickle-down effect as more people remain in rentals |

| Local Governments | Slower home turnover reduces property tax base expansion |

| Builders & Developers | Difficult permitting process and slow approvals |

| Young Families | Harder to upsize within city boundaries |

The affordability that once made Chicago a haven from coastal pricing extremes may soon be gone — unless construction accelerates and policy addresses housing access and equity.

What Can Be Done?

Policymakers and housing advocates are floating several options:

-

Zoning Reform: Easing regulations to allow more multi-family development

-

Permit Streamlining: Reducing bureaucratic delays for builders

-

Incentives for Sellers: Encouraging low-rate homeowners to list with tax breaks

-

Down Payment Support: Helping first-time buyers compete in bidding wars

Still, without broader systemic changes, experts warn Chicago could face a long-term affordability crisis.

Expert Voices & Public Insight

Michael Jacobson of the Illinois Hotel and Lodging Association noted in a recent forum, “We’re facing a supply problem at every end of the housing chain — and when we can’t build fast enough, it locks everyone out.”

Meanwhile, housing nonprofits are pushing for faster implementation of Accessory Dwelling Units (ADUs) in eligible zones to expand the supply of lower-cost housing options.

Sources for Further Reading

Have you been priced out of a home in Chicago this year? Or are you one of the sellers waiting for the right moment to list? We want to hear your story. Visit ChicagoSuburbanFamily.com to share your experience or read more local housing updates.