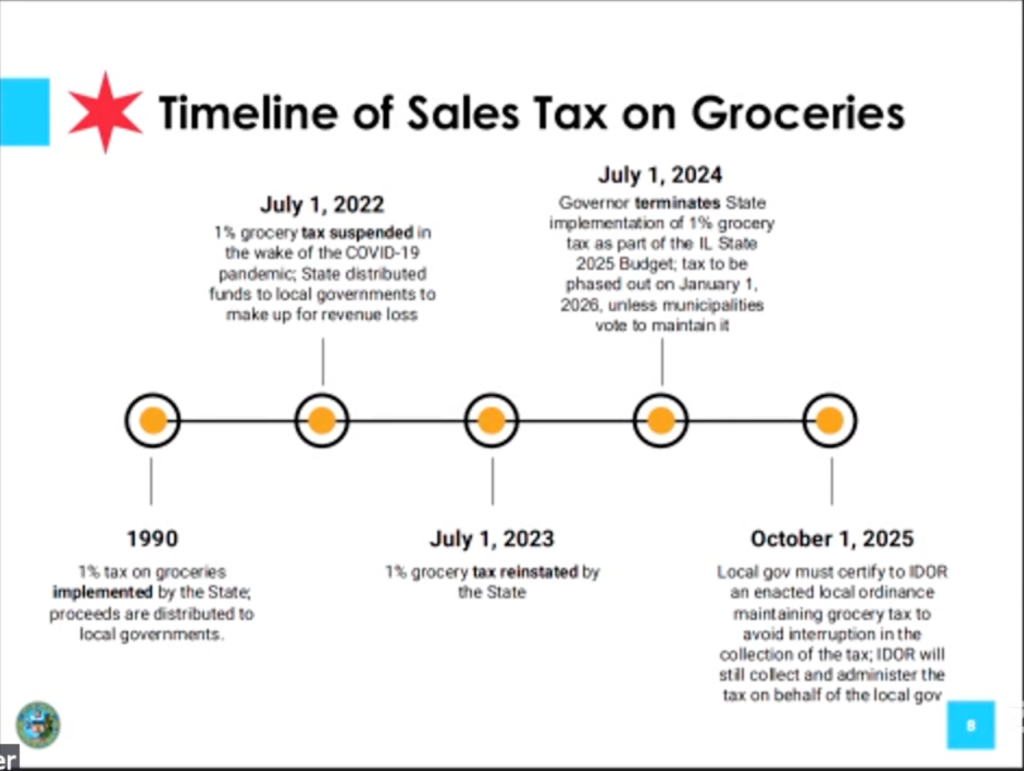

CHICAGO, IL — Despite a statewide plan to eliminate Illinois’ grocery tax by January 2026, Mayor Brandon Johnson’s administration wants to continue charging Chicagoans the 1 percent tax — citing a looming city budget deficit that could exceed $1.1 billion next year.

The tax, which adds 1% to the cost of most food prepared for off-site consumption, was repealed at the state level in 2023 as part of Gov. JB Pritzker’s 2025 budget. But the law allows individual municipalities to continue charging the tax if they pass their own ordinance by October 1, 2025.

Why Chicago Wants To Keep It

Speaking at a City Council subcommittee meeting on Tuesday, Budget Director Annette Guzman said not reaffirming the tax would cost the city $80 million in 2026 — money the administration argues is essential to maintaining city services.

“Allowing that tax to lapse in January 2026 would cost the corporate fund an estimated $80 million next year alone,” Guzman warned. “Nearly 200 other municipalities in Illinois… have already voted to extend this grocery tax.”

Mayor Johnson echoed that view, arguing the move isn’t a new tax, but rather a local continuation of an existing one:

“We’re not creating a grocery tax,” Johnson said. “We’re just creating a process by which we can collect it.”

City Council May See New Ordinance This Summer

Ald. William Hall (6th), a close Johnson ally and chair of the revenue subcommittee, said he expects a grocery tax ordinance to be introduced before the summer ends to meet the deadline.

Hall criticized state lawmakers for passing the decision to municipalities, calling it “headline budgeting.”

“We need $80 million, there’s no ifs, ands or buts about it,” Hall said. “The rate on which we tax and what’s feasible and fair — that’s to be determined.”

Mixed Reactions Among Council Members

Ald. Andre Vasquez (40th) said he wasn’t ready to support extending the tax, suggesting the Johnson administration first demonstrate it’s doing more to control costs.

“If you haven’t shown people that you’re willing to tighten the belt at all,” Vasquez said, “it becomes a lot harder to make that ask of the public.”

He also referenced the public backlash over past taxes like Cook County’s controversial soda tax, which was repealed in 2017.

What’s Next

If the city wants to keep collecting the tax without disruption, an ordinance must be passed and submitted to the state by October 1, 2025. Because City Council doesn’t meet in August, officials only have a narrow window to act this summer.

The grocery tax applies to most food purchased for off-site consumption, except food bought using SNAP benefits.

Do you support continuing Chicago’s grocery tax beyond 2026 to avoid city service cuts — or should it expire like the state planned? Share your thoughts below. How do you think the city should handle its $1.1 billion budget shortfall?