CHICAGO — After a painful emergency room visit in December 2023, Andrew Ciaccio found himself saddled with over $10,000 in medical debt. Despite working full-time and earning between $60,000–$70,000 a year, he couldn’t avoid the crushing financial weight of hospital bills — bills that, by all accounts, he may have qualified to have waived.

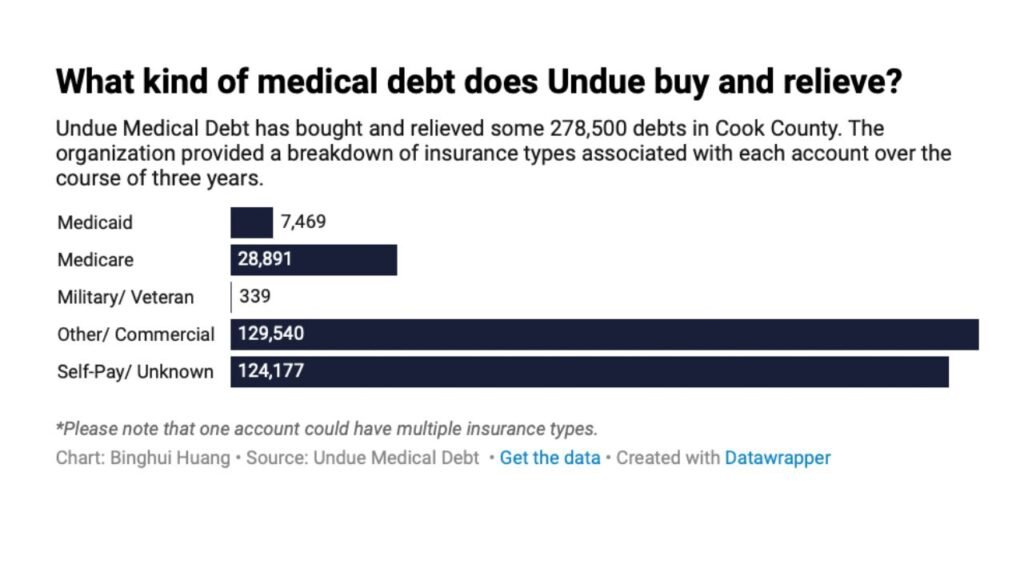

His experience is far from unique in Cook County, which in recent years has emerged as a national leader in medical debt relief. Since 2022, the county has spent more than $4 million to wipe out nearly $500 million in medical debt, offering aid to 278,000 residents. But as Ciaccio’s story shows, many people are still falling through the cracks.

A New Approach to a Growing Crisis

Cook County became the first local government in the nation to buy up medical debt in bulk, working with the nonprofit Undue Medical Debt to negotiate deals with hospitals and collections agencies. By purchasing medical debt for pennies on the dollar, the county could relieve thousands of residents with a relatively small public investment.

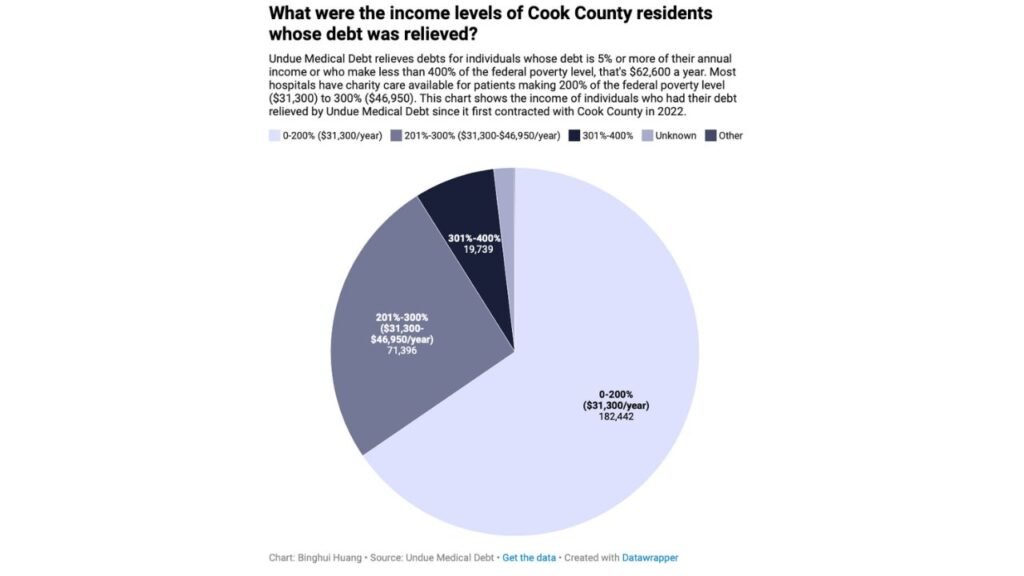

Yet a majority of the debt forgiven belonged to people who likely should have received charity care in the first place — those earning below 200% of the federal poverty level. This suggests that hospitals are not properly identifying or informing low-income patients about their eligibility for free or reduced-cost care.

“We are going to capture people that have gotten lost and fall through the cracks,” said Eva Stahl, Vice President of Public Policy at Undue Medical Debt.

How Patients Slip Through the System

Even with private insurance, middle-class patients are increasingly unable to afford hospital stays. Ciaccio, like many others, faced delayed billing estimates, overwhelming paperwork, and aggressive collections.

Another patient, Sarah Panahi, shared that despite earning a stable income as a grant writer and having insurance through BlueCross BlueShield PPO, she ended up owing thousands after a psychiatric hospital stay triggered by financial stress.

“My insurance paid over $10,000 — but I still owed more than $2,000 in deductibles, copays, and coinsurance,” she said.

This reflects a national trend. According to a Crowe analysis, medical debt from patients with commercial insurance grew from 11% of total debt in 2018 to over 57% by 2021.

Hospitals and Insurers Shift the Burden

The tension between hospitals and insurance companies over pricing has long been blamed for rising out-of-pocket costs. But while these massive institutions debate, patients bear the brunt.

“There is this unsustainable war between two Goliaths,” said Eli Rushbank of Dollar For, a nonprofit that helps patients access charity care. “And patients are the collateral damage.”

Hospitals sometimes deny care, garnish wages, or even place liens on homes to collect on medical debt. Although some systems, like Advocate Health, claim they’ve ended these practices, the implementation remains inconsistent — leaving people like Ciaccio still facing threats to their credit and livelihood.

Why Medical Debt Relief Is Often Too Late

While forgiving medical debt can boost credit scores and provide emotional relief, research by Stanford University economist Neale Mahoney found its impact is limited when debt is forgiven years after the medical event. By that point, patients may have already endured collections harassment or skipped needed follow-up care.

“It’s the result of bad luck, not bad financial behavior,” Mahoney emphasized. “Most people don’t choose to go to the ER.”

The Gaps in Illinois Policy

Despite a 2014 Illinois law that requires hospitals to fast-track charity care for vulnerable populations — including the homeless or Medicaid-eligible patients — many still never receive aid.

-

Nearly 2 out of 3 Cook County residents whose debt was forgiven earned less than $31,000 a year.

-

Dollar For found more than half of eligible patients never apply for charity care, largely because they don’t know it exists or can’t navigate the paperwork.

Shepard Searl, a patient who took a job at Starbucks for the insurance, eventually fell into debt due to recurring health emergencies. With no system proactively informing them of their eligibility, they relied on a GoFundMe campaign to avoid financial ruin.

Policy Changes and Local Innovations

Cook County’s model is spreading. Over 20 local governments nationwide have since launched similar medical debt relief programs.

Some counties, like Los Angeles, now require hospitals to report key data on collection practices and financial aid distribution — offering a transparency framework that Illinois could adopt.

Meanwhile, North Carolina leveraged federal Medicaid expansion funds to force hospitals to forgive debt and expand eligibility for charity care — a step Illinois lawmakers might consider.

And in 2025, a new Illinois law took effect forbidding credit agencies from factoring medical debt into credit scores — a key win for patient advocacy groups.

What Needs to Happen Next

While Cook County’s initiative is commendable, experts say true reform lies in preventing medical debt, not just forgiving it.

-

Automatic charity screening should be standard across hospitals.

-

State-level enforcement must ensure hospitals follow through on aid programs.

-

Better patient education and navigation support can bridge gaps before debt spirals.

“We need to think about prevention so we’re not putting people in that position,” said Mara Heneghan, former policy director for the county’s debt relief program.

How This Affects You

Medical debt doesn’t just hurt individuals — it impacts:

-

Local taxpayers, who fund debt buyouts and public healthcare systems.

-

Businesses, whose employees may avoid care due to cost, leading to productivity loss.

-

The healthcare system, burdened by unpaid bills and overreliance on emergency care.

Illinois residents can protect themselves by:

-

Asking hospitals about charity care eligibility up front.

-

Using tools like Dollar For to check eligibility for financial aid.

-

Reviewing hospital financial assistance policies before signing treatment documents.

Join the Conversation

Have you or someone you know faced unexpected medical debt in Cook County? Share your story or insights in the comments — or explore resources to get help.

ChicagoSuburbanFamily.com for more in-depth stories that matter to Illinois families — from housing to healthcare, we’ve got your back.