CHICAGO — Illinois’ ballooning public pension crisis has long been a political powder keg, but its consequences now reach into the daily lives of millions of residents across the state. With total pension liabilities reaching an estimated $237 billion, Illinois faces one of the worst-funded public pension systems in the country.

As lawmakers, analysts, and residents search for long-term solutions, the financial ripple effects are becoming unavoidable: higher property taxes, strained city services, reduced benefits for newer workers, and rising tensions between fiscal responsibility and retirement security. These effects are now forcing hard choices at every level of governance — from school boards to city councils — as communities scramble to fulfill obligations while maintaining essential services.

How Did We Get Here?

Illinois’ pension crisis didn’t appear overnight. For decades, state legislators underfunded pension plans, skipped annual contributions, and relied on overly optimistic investment returns to balance budgets. The reliance on unsustainable fiscal practices was further exacerbated by political short-termism — leaders prioritizing re-election over responsible financial stewardship. Combined with constitutionally guaranteed benefits and generous retirement packages for public employees, this has created a long-term, structurally unsound system.

- The state operates five major systems: TRS (Teachers), SERS (State Employees), SURS (Universities), JRS (Judges), and GARS (General Assembly).

- In addition, local systems like Chicago Police, Chicago Fire, Municipal, and Cook County pensions face similar shortfalls.

Many municipalities now spend 30-40% of their operating budgets on pension contributions, draining funds away from education, infrastructure, and emergency services. In some towns, pensions take up more than public safety, leading to officer shortages, unmaintained streets, and cuts to after-school programming.

Who Pays the Price?

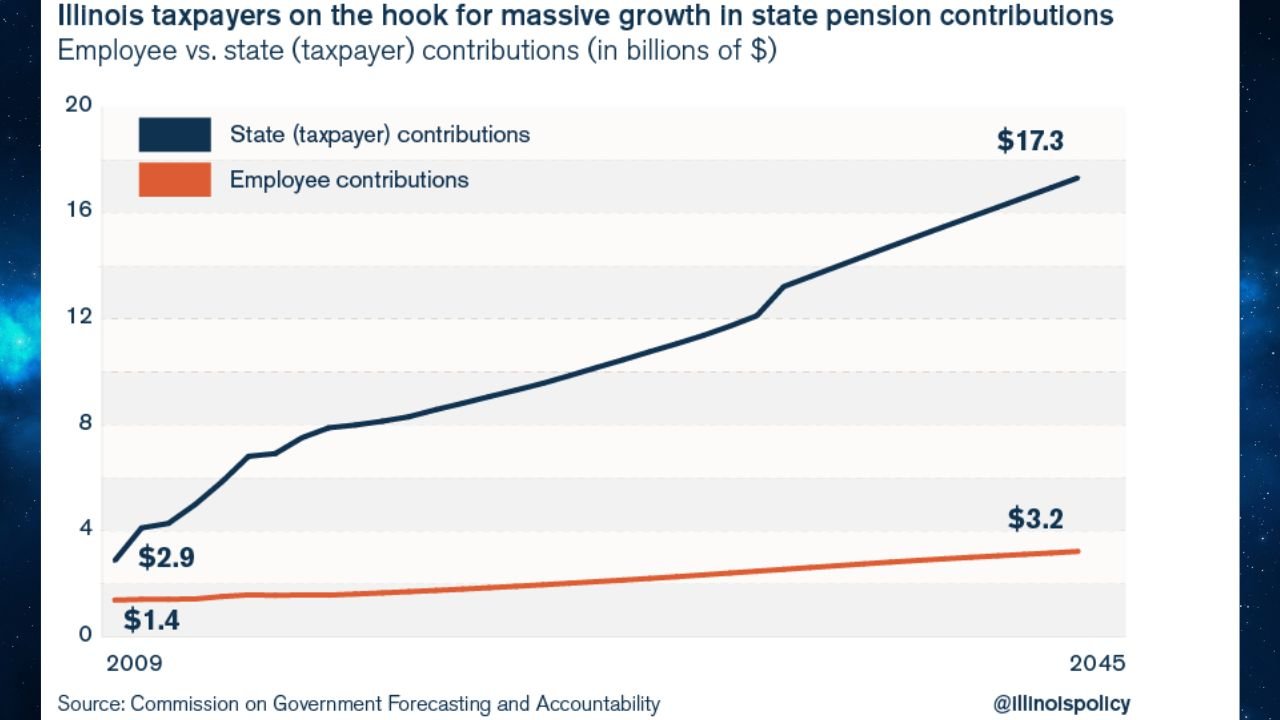

A closer look reveals that the burden is falling heavily on Illinois taxpayers, including:

- Homeowners facing property tax increases across the state

- Public employees in Tier 2 plans who pay more but receive fewer benefits

- Business owners hurt by high commercial tax rates and uncertain public budgets

- Young families and seniors watching services shrink while costs rise

What’s more, the long-term uncertainty undermines faith in government. Residents feel they are being punished for the mistakes of the past, while many public employees feel betrayed as promised retirement benefits come under scrutiny.

Everyday Impacts on Illinois Residents

| Area | Impact |

|---|---|

| Property Taxes | Large increases in Cook County and beyond to cover gaps |

| Local Services | Fewer resources for public safety, libraries, and roadwork |

| School Budgets | Less money for teachers and classroom resources |

| Small Business Climate | Rising taxes and lowered infrastructure investment |

| Retirement Inequity | Tier 2 workers receive less, risking federal non-compliance |

| Community Stability | Families consider moving out of state due to instability |

| Housing Market Impact | Higher taxes reduce affordability and home values |

These financial consequences touch every neighborhood. In urban areas, families are worried about escalating rent driven by tax hikes. In rural communities, the inability to attract and retain educators and first responders due to lower benefits poses long-term risks.

How Illinois’ Pension Crisis Affects Stakeholders

This bar chart shows the ripple effect across communities:

- Residents: Most directly hit through property taxes

- Municipalities: Must cut services to meet obligations

- Workers: See lower take-home pay and weaker retirement benefits

- Businesses: Pay higher local taxes, which can discourage investment

In the long run, persistent pension debt lowers Illinois’ credit rating, increasing borrowing costs for everything from school construction to water system upgrades.

What’s Being Done?

State leaders have debated solutions for years, but progress has been slow due to constitutional protections and political gridlock. Here are some current efforts and proposals:

- Tier 2 Reforms: Policymakers are under pressure to fix Tier 2 before federal penalties kick in. Without reform, Illinois could face sanctions for offering retirement plans deemed insufficient under federal Social Security equivalency.

- Pension Obligation Bonds: Some cities have used these to restructure short-term costs, but critics warn they only delay the problem and increase risk.

- New Legislation: Proposals include constitutional amendments that would allow adjustments to future, unearned benefits while protecting accrued ones.

- Enhanced Transparency: Civic groups and watchdogs are pushing for public dashboards and pension disclosure laws that make it easier to track local liabilities.

- Municipal Innovations: Cities like Peoria and Rockford are piloting hybrid approaches that mix defined contribution elements with traditional pensions.

Track your local system: pensions.illinoisanswers.org

Key Questions for Illinois Residents

- Why should I care about pension funding?

Because it affects everything from your property taxes to school funding, and whether your fire station remains open. - Are these problems only in big cities like Chicago?

No — municipalities across the state are impacted, including downstate communities where local tax bases are smaller. - What if the state defaults or underpays again?

Public workers still expect payments, which could lead to more borrowing, service cuts, and potential litigation. - Can I see how much debt my city owes?

Yes. Use tools like the Better Government Association Salary Tool or Illinois Answers’ Public Pensions Database. - Could federal support be a solution?

While some have floated federal bailouts, they are politically controversial and unlikely. Structural reform remains the more viable path.

What Comes Next?

Experts warn that Illinois is nearing a fiscal tipping point. Without reforms, pension costs could consume more than half of state and local budgets within a decade — with devastating implications for everything from healthcare access to climate resilience.

Still, reforms come with political risks. Changing pension rules could spark court challenges or labor unrest. Yet delaying change may leave the next generation with fewer services, more debt, and higher taxes. Meanwhile, bond rating agencies and institutional investors continue to monitor Illinois’ fiscal trajectory closely.

The state’s future may depend on whether current leaders can build bipartisan support for structural reform while preserving retirement dignity for long-serving public workers.

How You Can Stay Informed and Involved

- Check your city’s pension stats via Illinois Answers’ tools

- Attend public budget hearings in your municipality

- Encourage local leaders to prioritize transparency, fiscal health, and long-term solvency

- Follow updates from watchdogs like the Civic Federation, BGA, Center for Tax and Budget Accountability, and Equable Institute

- Demand performance audits and pension stress tests at the local level

Final Thought

Illinois’ pension crisis is more than a budget line — it’s a moral and economic crossroads. It’s a test of long-term governance, fiscal responsibility, and intergenerational fairness. Residents, public servants, and policymakers must now decide whether to protect the status quo or secure a sustainable future. The coming years will determine whether Illinois emerges stronger — or stumbles further under the weight of promises made but not kept.

Have you seen pension shortfalls impact your town’s schools, police or taxes? Share your story with us in the comments or at ChicagoSuburbanFamily.com and help others understand the local impact.