CHICAGO — Illinois residents are facing a mounting student loan crisis, with nearly $63 billion in collective debt affecting over 1.6 million borrowers statewide. For many, this burden delays homeownership, limits career options, and threatens long-term financial health. Yet amidst the crisis, a growing number of state programs, legal tools, and innovative solutions are offering real relief—if borrowers know where to look.

This deep dive explores how Illinois is confronting the student debt dilemma and what options local residents can pursue to protect their finances, qualify for forgiveness, and avoid passing down debt to their families.

The Weight of Debt: A Barrier to Opportunity

For many borrowers like Josue Villalpando, a University of Illinois Chicago graduate, the idea of homeownership seemed far out of reach. He held $49,000 in student loans, mostly private—known for higher interest rates and fewer protections. Then, he discovered SmartBuy, a state housing incentive that paid off his debt and helped him secure a home in Lansing.

“With my student loans being fully paid off, I know I can comfortably pay my mortgage without having to worry about financial constraints,” said Villalpando.

But not everyone has access to such relief. With Illinois ranking seventh in the nation for average student debt, and rising tuition costs outpacing inflation, many feel hopeless.

SmartBuy: A Housing Lifeline for Borrowers

SmartBuy is one of Illinois’ most promising responses to student debt. Created under Governor Pritzker’s Rebuild Illinois Plan, the program offers:

-

Up to $40,000 in student loan repayment

-

$5,000 toward down payment or closing costs

-

Support for first-time homebuyers with qualifying credit and income levels

To qualify, borrowers must:

-

Pay off the full balance of their student debt at the time of home purchase (SmartBuy contributes up to $40K)

-

Have a credit score of at least 640

-

Reside in the home for at least three years

Out of 755 homes purchased, over 87% were in the Chicago region, proving how targeted investment can make homeownership accessible even in high-debt environments.

Details: IHDA SmartBuy Program

Federal Relief in Jeopardy: What Illinois Borrowers Should Know

National forgiveness programs are facing major legal and structural hurdles. The SAVE Plan—an income-driven repayment plan introduced under President Biden—was paused by federal injunction earlier this year. Meanwhile, the U.S. Department of Education is being dismantled, with loan oversight moving to the Small Business Administration.

These changes have left many borrowers confused about their options. Attorney Rae Kaplan, who specializes in student loan relief, warns:

“Student loans were meant to lift people up, not to be this weight dragging everybody down.”

Key Forgiveness Programs for Illinois Residents

Despite federal uncertainty, Illinois offers multiple state-administered loan relief programs, especially for public service workers:

| Program Name | FY25 Allocation |

|---|---|

| Community Behavioral Health Care Loan Repayment | $7.5M |

| Human Services Professional Loan Repayment | $5.25M |

| Illinois Teachers Loan Repayment | $975K |

| Nurse Educator Loan Repayment | $500K |

| Veterans’ Home Medical Providers Repayment | $26.4K |

More info: ISAC Forgiveness Programs

Borrowers can also apply for Public Service Loan Forgiveness (PSLF), which forgives balances after 120 qualifying payments for those in government or nonprofit roles. Kaplan estimates nearly 30% of Illinois residents qualify but only 18% ever apply.

PSLF details: studentaid.gov

Private Loans: Limited Relief, New Approaches

While federal loans dominate the landscape, about 10% of Illinois grads hold private student loans. To help these borrowers, the Illinois State Treasurer launched the Student Empowerment Fund, a $1.5B pool to lower interest rates on private loans for in-state students.

More info: Illinois SEF

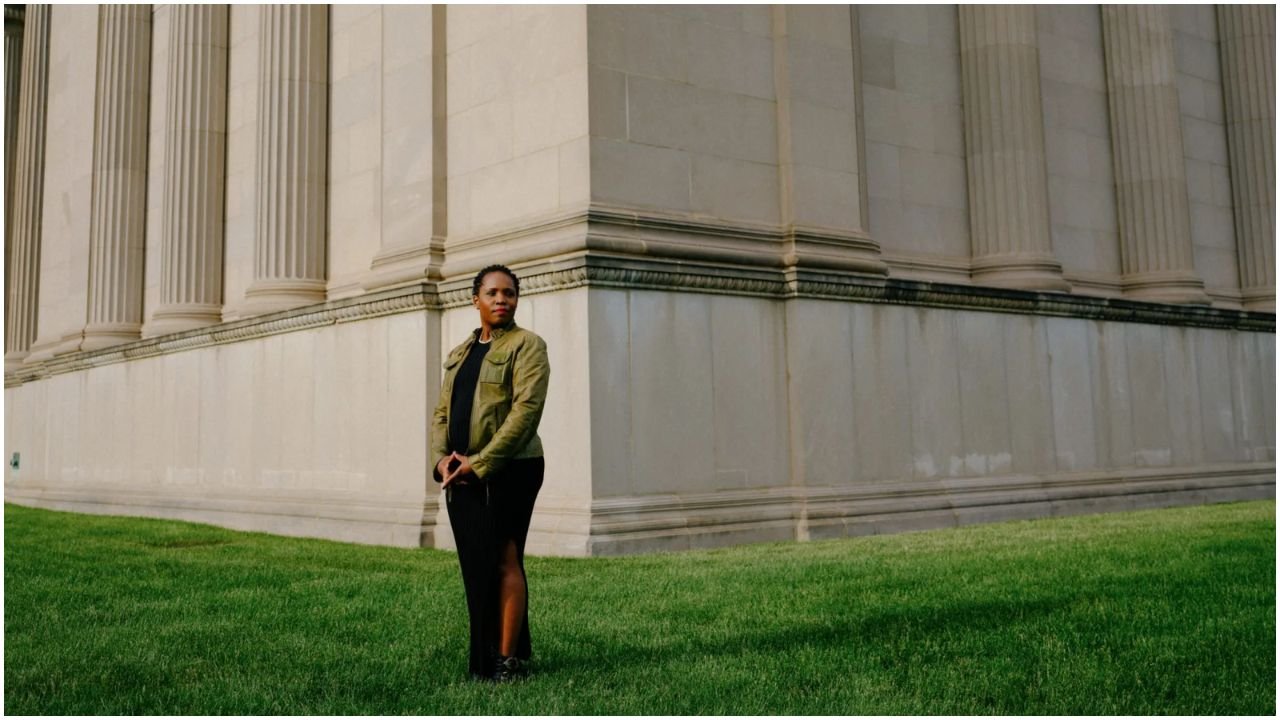

The Human Toll: Borrowing With No Safety Net

Nicole Johnson, a former CPS teacher and three-time master’s degree holder, carries over $200,000 in student loan debt. Despite working in public service, she said debt has impacted everything from her mortgage rates to future family planning.

“Education was the thing that opened so many doors for me… but now I wonder how my kids will be able to go to college,” she said.

What Borrowers Can Do Now

For those carrying student loan debt in Illinois, here are five steps you can take today:

-

Check your eligibility for SmartBuy if you’re house-hunting

→ IHDA SmartBuy -

Explore ISAC forgiveness programs tailored to your profession

→ ISAC Repayment Programs -

Apply for PSLF if you work in public service

→ PSLF Info -

Consult a loan attorney for private loan relief or strategy

→ Kaplan Law Office -

Stay updated on federal forgiveness programs and legal changes

→ Federal Student Aid News

Proposed Reforms: What’s Coming Next

The Chicago Bar Foundation has proposed legislation to:

-

Cap borrowing amounts

-

Introduce simplified income-driven repayment tiers

-

Allow bankruptcy discharge for student loans as a last resort

While unlikely to pass during the current Congressional term, the proposal aims to address systemic inequities and give borrowers a fair path forward.

Full proposal: Chicago Bar Foundation

Are you or someone you know struggling with student loan debt in Illinois? Share your experience or check if you qualify for SmartBuy or ISAC programs today. Your story could help others at ChicagoSuburbanFamily.com.