What if the problem with the economy isn’t about how much money we have — but how it moves?

That’s the core idea behind the “Good Life Economy,” a compelling framework introduced by Aaron Smith, founder of Aegis Station Infrastructure LLC. In a widely shared article on LinkedIn, Smith outlines a consumer-driven engine for sustainable economic growth that flips traditional “trickle-down” assumptions on their head.

A Bottom-Up Model With Upward Momentum

Rather than relying on capital injection at the top and hoping it “trickles down,” Smith proposes inserting liquidity directly at the consumer level — where it can flow upward through real transactions, jobs, savings, and reinvestment.

“Money has negative gravity,” Smith writes. “Left alone, it tends to rise—accumulating, concentrating, and eventually slowing down.”

The solution? Inject money at the base — and let it naturally circulate up.

How The Cycle Works

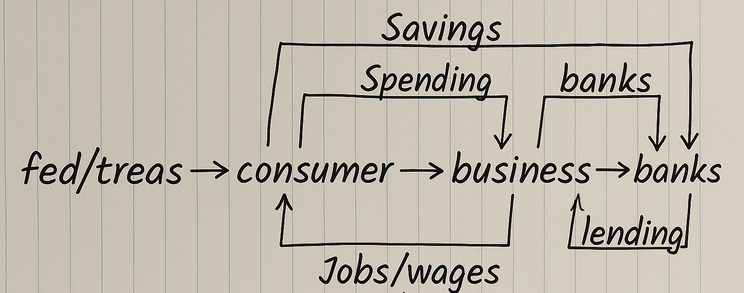

The “Good Life” model follows a five-stage economic cycle:

-

Government → Consumer

Income support, universal dividends, or tax credits directly into households. -

Consumer → Business

People spend on goods and services, generating immediate demand. -

Business → Banks

Revenues become deposits and capital. -

Banks → Business

Financial institutions reinvest in companies, fueling growth and hiring. -

Business → Jobs → Consumer

Jobs return to households, restarting the loop.

Unlike vertical extraction models that concentrate wealth, this system emphasizes velocity and circulation — like a healthy bloodstream.

Why This Matters

Traditional models often assume that if capital accumulates at the top, some will eventually filter down to everyone else. But Smith argues this leads to:

-

Bottlenecks

-

Speculative bubbles

-

Boom-bust credit cycles

“That’s not circulation — it’s leakage,” he writes.

The Good Life Economy starts with movement, not mass — prioritizing an active economy based on exchange, reinvestment, and return.

What Policies Fit This Model?

Smith emphasizes that this isn’t about ideology. The framework is compatible with multiple policy directions:

-

Universal Basic Income (UBI)

-

Targeted income supports

-

Earned income tax credits

-

Public banking initiatives

-

Infrastructure with household dividends (transit, housing, health access)

It’s not redistribution — it’s redirection toward systemic motion.

Potential Outcomes

If well-implemented, a bottom-up economy could:

-

Improve economic resilience

-

Support local businesses

-

Reduce credit dependency

-

Increase labor dignity and inclusion

-

Center the economy on people, not just capital

What do you think of Aaron Smith’s “Good Life Economy” model?

Do you believe a bottom-up approach could strengthen economic stability in your community?

Join the conversation at ChicagoSuburbanFamily.com and share your thoughts on economic renewal.